THE PYTHON QUANTS

GROUP

The Experts in Data-Driven and AI-First Finance with Python. We focus on Python and Open Source Technologies for Financial Data Science, Artificial Intelligence, Asset Management, Algorithmic Trading, and Computational Finance.

Our Group

TECHNOLOGY

Quant Platform brings you browser-based, interactive, collaborative data & financial analytics using Python and other open source technologies. DX Analytics brings powerful derivatives and risk analytics to Python. Benefit from the latest trends in the Python ecosystem.

TRAINING

Benefit from our experience in Python, Machine Learning, and Quantitative Finance to master Python for Financial Data Science, Asset Management, Computational Finance, and Algorithmic Trading. Earn a prestigious Certificate to supercharge your career in the financial industry.

YOUR PARTNER FOR PYTHON

FOR QUANTITATIVE FINANCE AND TRADING

The Experts in AI-first Finance with Python.

for Financial Data Science, Artificial Intelligence, Asset Management,

Algorithmic Trading, and Computational Finance.

- CERTIFICATE PROGRAM IN PYTHON FOR FINANCE

- FOR PYTHON QUANTS BOOTCAMP IN LONDON (NOV 2019)

- DATAFRAMED PODCAST WITH YVES HILPISCH

- PYTHON PODCAST WITH YVES HILPISCH ON QUANT FINANCE

- HASHING, ENCRYPTION, BLOCKCHAIN & BITCOIN MINING WITH PYTHON

- TPQ TOP 10 BANKING ANALYTICS SOLUTION PROVIDER OF 2017

- PYTHON FOR FINANCE (O'REILLY) & OTHER BOOKS

- TPQ TOP 10 ALGO TRADING SOLUTIONS PROVIDER IN 2019

- OVERVIEW SESSION FOR THE CERTIFICATE PROGRAM

- TALKPYTHON['PODCAST'] WITH YVES HILPISCH

- TPQ BEST 50 COMPANIES TO WATCH IN 2017

- SIGN UP FOR OUR FREE PYTHON FOR FINANCE EMAIL COURSE

- CHAT WITH TRADERS PODCAST WITH YVES HILPISCH ON PYTHON

- PRESENTATIONS AND RESOURCES BY YVES HILPISCH

OUR PRODUCTS & SERVICES

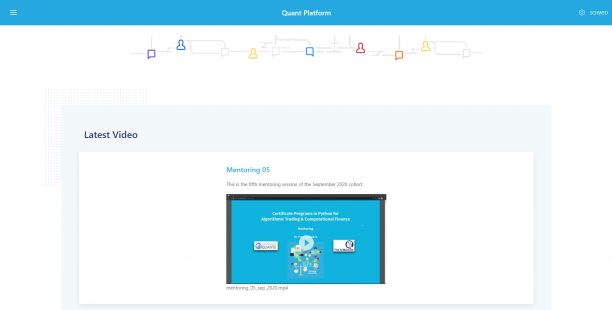

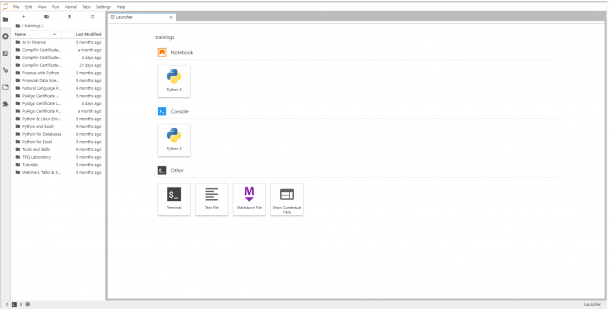

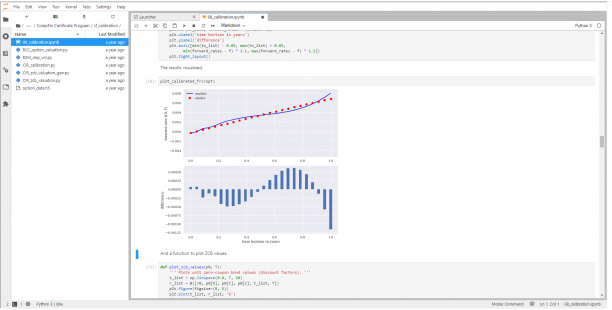

QUANT PLATFORM

BROWSER-BASED FINANCIAL ANALYTICS

Experience a new level of productivity and a new approach to collaboration in financial analytics. The platform offers eg Jupyter Notebooks, full browser-based shell acess, GUI-based filemanagement, project/file sharing & publishing. Get a free trial.

SIX BOOKS

CONDENSED KNOW-HOW

Yves Hilpisch, CEO of The Python Quants and The AI Machine, has authored six books on the use of Python for Quantitative Finance. The first is Python for Finance (O’Reilly, 2018, 2nd ed.) which has become the standard reference on the topic. The second is Derivatives Analytics with Python (Wiley Finance, 2015). The third is Listed Volatility & Variance Derivatives (Wiley Finance, 2016), followed by Artifical Intelligence in Finance (O’Reilly, 2020) and Python for Algorithmic Trading (O’Reilly, 2020). The latest if Financial Theory with Python (O’Reilly, 2021).

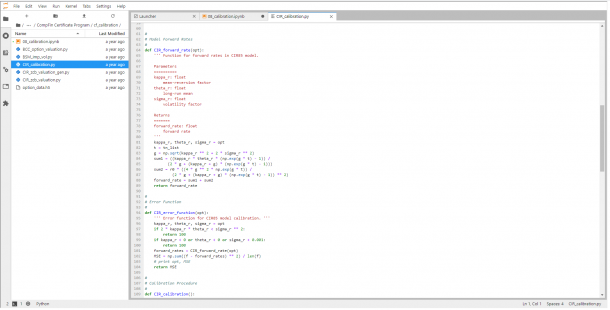

DX ANALYTICS

DERIVATIVES & RISK ANALYTICS

Completely modular and object-oriented open source library to model, manage, price, and risk manage complex portfolios of (multi-risk) derivatives with potentially complex correlations structures. Optimize portfolios, value interest swaps and more. Visit http://dx-analytics.com.

SERVICES & TRAINING

LET'S DO IT TOGETHER

We help you in any way to start using Python for Quant Finance, to solve specific problems, or to conduct ambitious, path-breaking projects. Be it with consulting, development, or training. We help you transition from e.g. Matlab or R and also in streamlining your financial analytics processes with Python.

QUANT PLATFORM

Experience new levels of productivity and collaboration in financial analytics.

Our approach to designing the Quant Platform is inspired by Bruce Lee's martial arts

philosophy: "Absorb what is useful, discard what is not, and add what is uniquely your own."

QUANT PLATFORM

Benefit from powerful features of the platform.

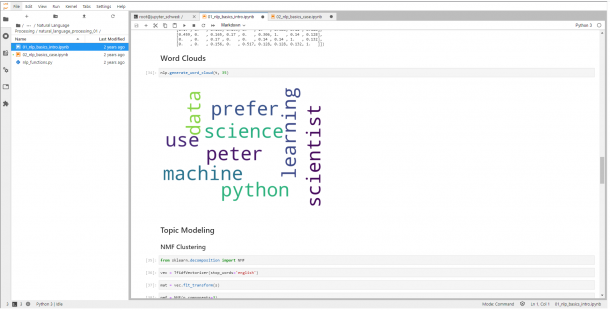

ANALYZE

Browser-based notebooks for interactive data analytics withPython

VISUALIZE

Easily visualize your data – both statically and interactively (D3.js)

EDIT & DEVELOP

Edit all typical code files within the browser (e.g. Python, HTML, CSS)

USE DATA

Easily upload, download and display your data, files, etc.

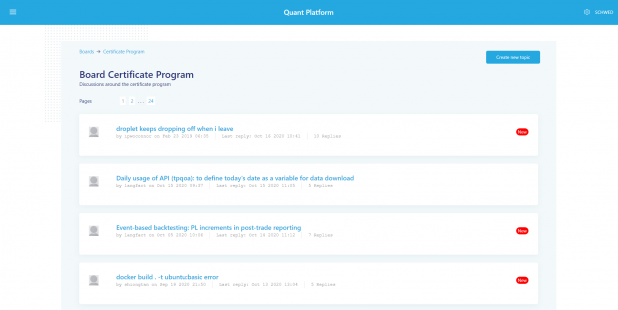

USER FORUM

Get support for and discuss Python for Finance topics in our active User Forum

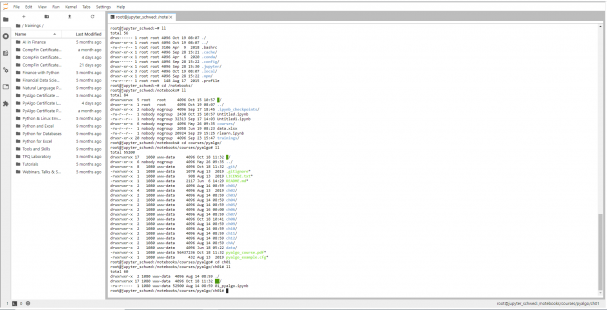

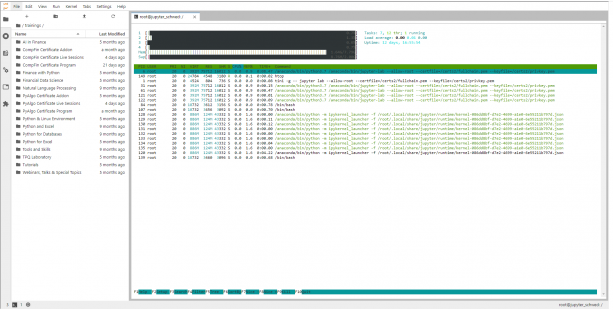

USE THE SHELL

Use all Linux tools that you love (e.g. Git, Vim, htop) in the browser

GET FINANCIAL

Benefit from libraries for advanced financial & risk analytics

PUBLISH & SHARE

Publish your documents & files, deploy your Web applications

COLLABORATE

Collaborate within your company, define projects, rights & roles

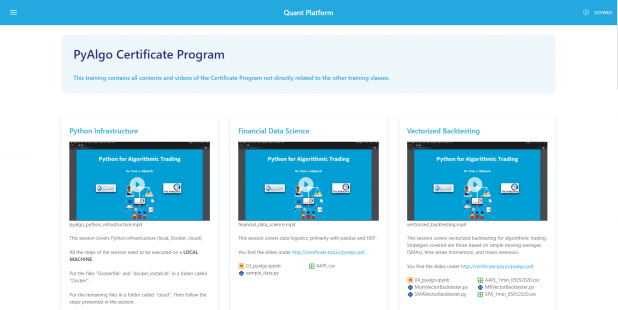

CERTIFICATE PROGRAM

Online training program in Python for Asset Management, Algorithmic Trading, and Computational Finance.

BASICS & TOOLS

MASTER THE PYTHON BASICS

Our program teaches the basics in mathematics, crypto, Python, data science, visualization, tools, and more. The goal is to bring you up to speed and to the brown or even black belt level. See the Certificate Program page.

ARTIFICIAL INTELLIGENCE

MACHINE & DEEP LEARNING

Machine learning nowadays is at the core of many technologies and applications. This holds true for finance as well. Our program has three dedicated classes for AI in Finance. See the Certificate Program page.

ALGO TRADING

BEAT THE MARKETS WITH PYTHON

A major focus of our Certificate Program lies on algorithmic trading based on traditional, technical trading strategies as well as based on machine & deep learning models. Nothing is as exciting as beating the markets. See the Certificate Program page.

Quantitative Finance

ASSET MANAGEMENT & PRICING

Asset management and the pricing of options and other derivatives instruments are highly technical, quantitative disciplines. Python is the ideal programming language to implement quantitative financial models. See the Certificate Program page.

DERIVATIVES ANALYTICS

WITH PYTHON

Data Analysis, Simulation,

Calibration, Hedging

Market-based valuation and management of equity options from theory and practical implementation. Wiley Finance, 2015.

Python for Algorithmic Trading

From Idea to Cloud Deployment

Learn all the Python skills to develop your algorithmic trading strategy from first idea to robust cloud deployment. O'Reilly, 2021.

PYTHON

FOR FINANCE,

2nd ED.

Mastering

Data-Driven Finance

Learn the relevant Python basics and profit from many real-world financial examples. Jupyter-based tutorial style. O'Reilly, 2018, 2nd ed.

ARTIFICIAL INTELLIGENCE IN FINANCE

A Python-based Guide

Learn all about data-driven and AI-first finance with Python. Apply neural networks to beat the markets. O'Reilly, 2020.

LISTED VOLATILITY &

VARIANCE DERIVATIVES

A Python-based

Guide

Introduction to listed volatility and variance derivatives with directly executable Jupyter Notebooks. Wiley Finance, 2017.

MANAGEMENT

Profit from our expertise: our team members are experts in Python for Data Science, Quantitative Finance,

Asset Management, Artificial Intelligence, Machine Learning, Excel, and more.

Reaching Us Is Easy

Get & Keep in Touch

-

The Python Quants GmbH

D-66333 Voelklingen - +49 3212 112 9194

- team@tpq.io

By signing up you agree to our Privacy Policy.

The Experts in Data-Driven and AI-First Finance with Python. We focus on Python and Open Source Technologies for Financial Data Science, Artificial Intelligence, Algorithmic Trading and Computational Finance.